I Want to Write off Real Estate Losses: Is This Your Situation

Corrigan Krause is a team of dedicated, passionate, experienced professionals who provide comprehensive accounting, tax and consulting services and solutions to individuals and privately-held businesses to help you make informed financial decisions.

Real Property Management Diversified

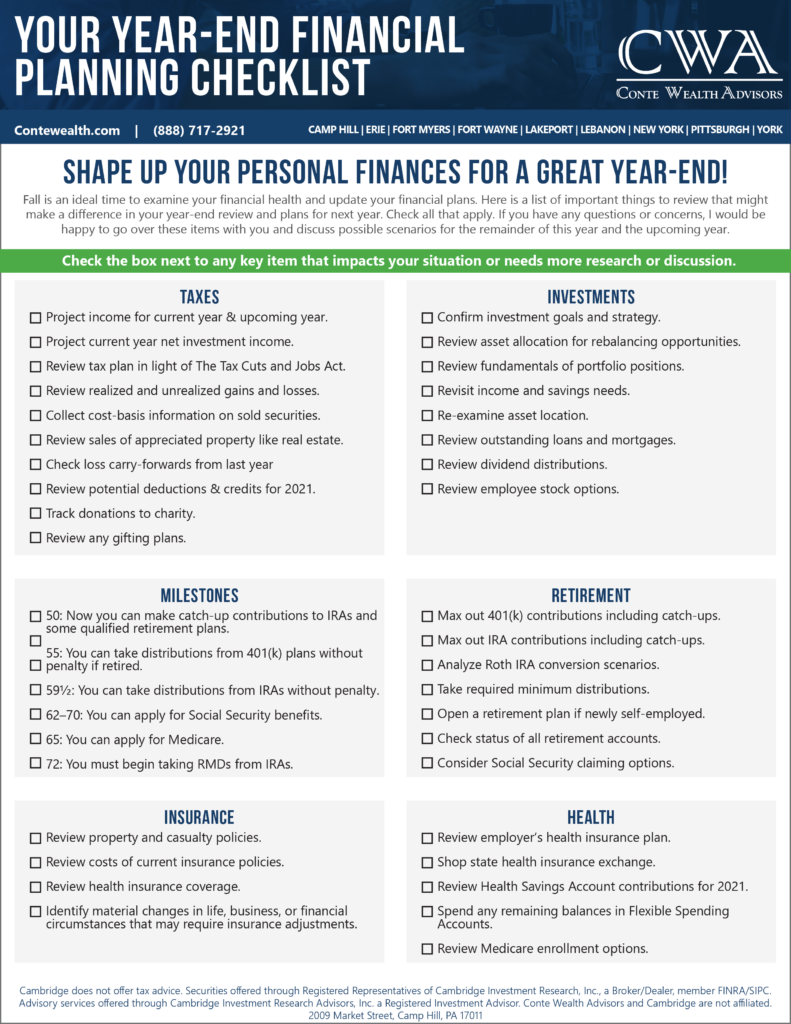

Your Year-End Financial Planning Checklist - Conte Wealth

How Long Should You Live In A House Before Selling?

Deducting Property Taxes

IRS Form 4684 Instructions - Deducting Casualty & Theft Losses

What Are the Tax Benefits of Investing in Real Estate? A Guide for Investors - Canyon View Capital

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

:max_bytes(150000):strip_icc()/tax-loss-carryforward.asp-Final-b28809370a574b75ab8b3f17621f3287.png)

Tax Loss Carryforward: How They Work, Types, and Examples

Passive/Suspended loss

Hall CPA PLLC

Private Real Estate vs. REITs

17 Big Tax Deductions (Write Offs) for Businesses

Tax Strategies for Short-Term Rental Properties

:max_bytes(150000):strip_icc()/writedown_final-e552217680ed4452a73f5a8efea5f450.png)

Write-Down: Definition in Accounting, When It's Needed and Impact

:max_bytes(150000):strip_icc()/top_tips_for_deducting_stock_losses-5bfc3456c9e77c0026b6a235.jpg)

Deducting Stock Losses: A Guide